API Overview

Introduction

Ezidebit’s API provides a fully PCI compliant payment solution to clients/partners in Australia and New Zealand.

The API provides the ability to process payments via a range of payment types (direct debit, real time, BPAY) via a powerful suite of widgets, Javascript methods and SOAP web services.

Payments can be processed from bank accounts, Visa Card, MasterCard and American Express, depending on the payment type.

API Components

Ezidebit’s API has the following core components.

Widgets

Ezidebit’s hosted widgets are powerful application components that can be “plugged” into your software, immediately offering rich features with a minimum development on your part.

The added benefit of using our widgets is that when used as specified, they ensure that your software design is fully PCI level 1 compliant.

Widgets include:

Javascript API Methods

Our Javascript API allows you to have control over the page. Your forms’ details can be sent directly to Ezidebit, and not via your server.

Web Services

We have SOAP web services that enable your customer management system to interface directly with Ezidebit’s payment processing cloud

With over 25 web services to choose from, they are designed to be platform and programming language agnostic to allow integration with Ezidebit, regardless of the language that your system is developed in. They are delivered securely over the internet using SOAP as standard XML based specifications designed for exchanging structured information over computer networks.

A number of web services exist for use by businesses/software that are already PCI compliant. Use of these methods must be approved by Ezidebit and evidence of existing PCI compliance must be provided (Certificate of Attestation or Self Assessment Questionnaire D). Specific web services that require this approval are indicated in the relevant sections below.

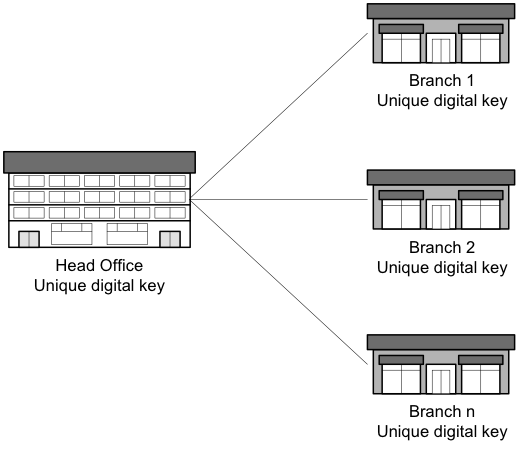

Sandbox

You will receive a unique Sandbox Digital Key and Public Key, which give you access to our test environment. You will also receive your login credentials for the sandbox Ezidebit Online portal (access will be read only).

Some settings may differ on your sandbox account to your live account, e.g. payment products available, fees and who is paying the fees.

Approach to Integration

Ezidebit has a dedicated Integration Services team who can work with you on the design and validation of your planned integration to ensure it meets all PCI and banking requirements. It is recommended that you contact the Integration Services team by emailing partner@ezidebit.com.au before commencing your development so that they can assist you with identifying the most appropriate API components to deliver your requirements.

Prior to go live of a new integration, the Integration Services team will complete a certification of the developed solution. This will include a review of the API components being used and a walkthrough of key functions, such as new payer sign up, processing of credit cards payments. Where PCI or banking requirements have not been met, certification will not be able to be provided until issues have been addressed.

An annual certification review will be completed by the Integration Services team.

Support can be requested at any time by emailing partner@ezidebit.com.au.

Testing information

When testing and debugging it is important to remember that typically SOAP Exceptions result from malformed or bad data presented in the XML. When you are debugging you should check both your program logic and the XML that it is producing as the request data. When you are communicating with Ezidebit about these Exceptions, it is important that you include the XML that was sent as the request to the web service with your enquiry; this will assist Ezidebit’s support staff in identifying any issue.

Testing of the integration using Ezidebit’s APIs must include not only testing relating to sending and receiving of data using the web services, but also that data received in responses is correctly dealt with in the client management system. For example, where retrieving payment data, the system must be able to correctly treat both successful and failed payments.

The following points should also be noted in relation to testing:

- Real-Time (Visa/MasterCard Only): Using our test set up via the test URLs allows you to test failed and successful payments for Visa and MasterCard depending on what number you enter for the number of cents in the payment amount. Zero cents (e.g. 100 or 100.00) will be successful. Any other number of cents will always fail with the failed reason corresponding to the number of cents (e.g. 100.51 as the payment amount will fail with error code 51, meaning insufficient funds). A list of the response codes is contained in Transaction Response Codes.

- Real-Time (American Express Only): Using our test set up via the test URLs allows you to test failed and successful payments for American Express depending on what expiry date is used. More details about this can be found in Transaction Response Codes.

- Direct Debit (Credit Card & Bank Account): In the Sandbox Environment, customers whose bank account or credit card number ends in a ‘2’ will have their test payment(s) dishonoured as “Insufficient Funds” and the customer will stay at a processing status. Customers whose bank account or credit card number ends in a ‘3’ will have their test payment(s) dishonoured as “Incorrect Bank Account/Credit Card Number” (Fatal Dishonour) and the customer record will be moved to a non-processing status. All other payments will be marked as successful. A list of response codes can be found in Bank Account Response Codes.

When testing in our Sandbox environment, processing is done at the following times:

| Country | Direct Debit Processing Time | Settlement Time |

|---|---|---|

| Australia | 2:30 am and 6:00 pm AEST | 10am AEST |

| New Zealand | 5:30am AEST | 8am AEST |

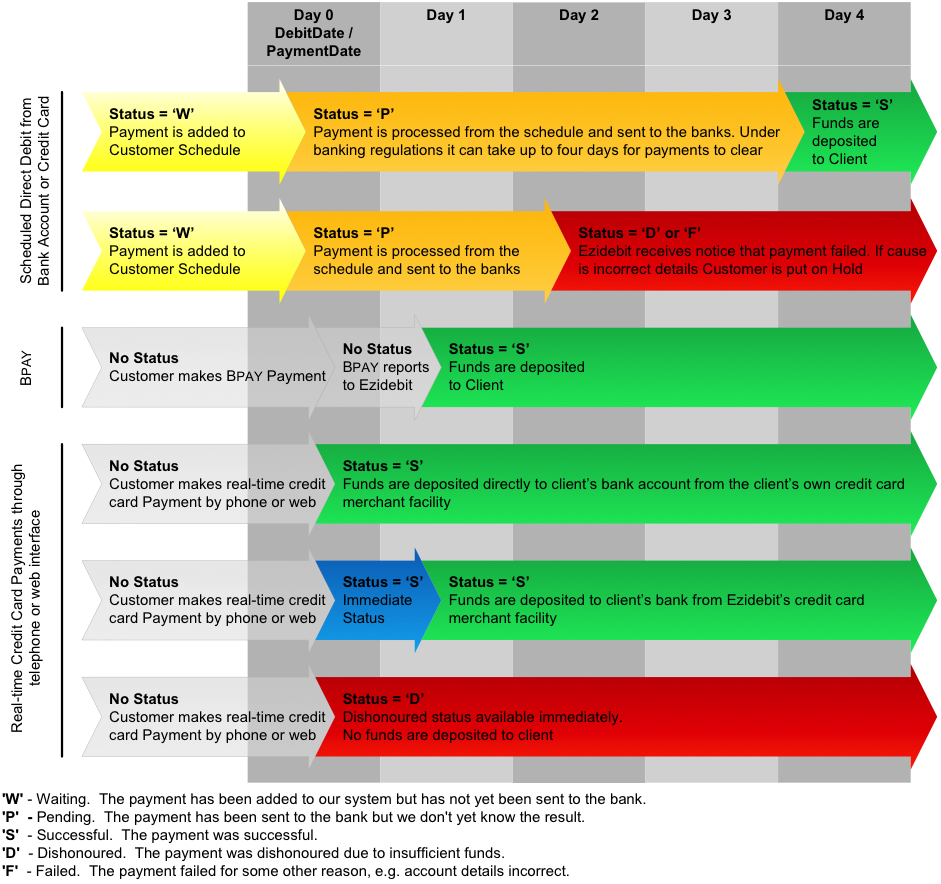

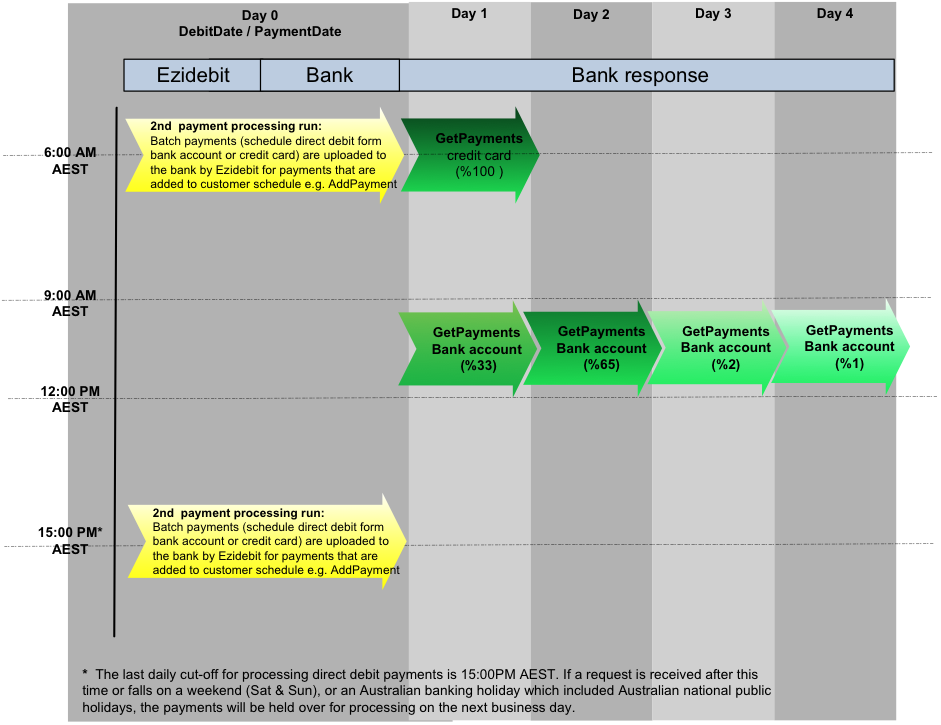

Payment Processing Times

Direct debit payments in the live environment are processed at the following times on each business day:

| Country | Direct Debit Processing Time | Settlement Time |

|---|---|---|

| Australia | 12:30 am, 6:30am and 3:00 pm AEST | By 8:30 am AEST |

| New Zealand | 1:30 am and 3:00 pm AEST | By 8:30 am AEST |

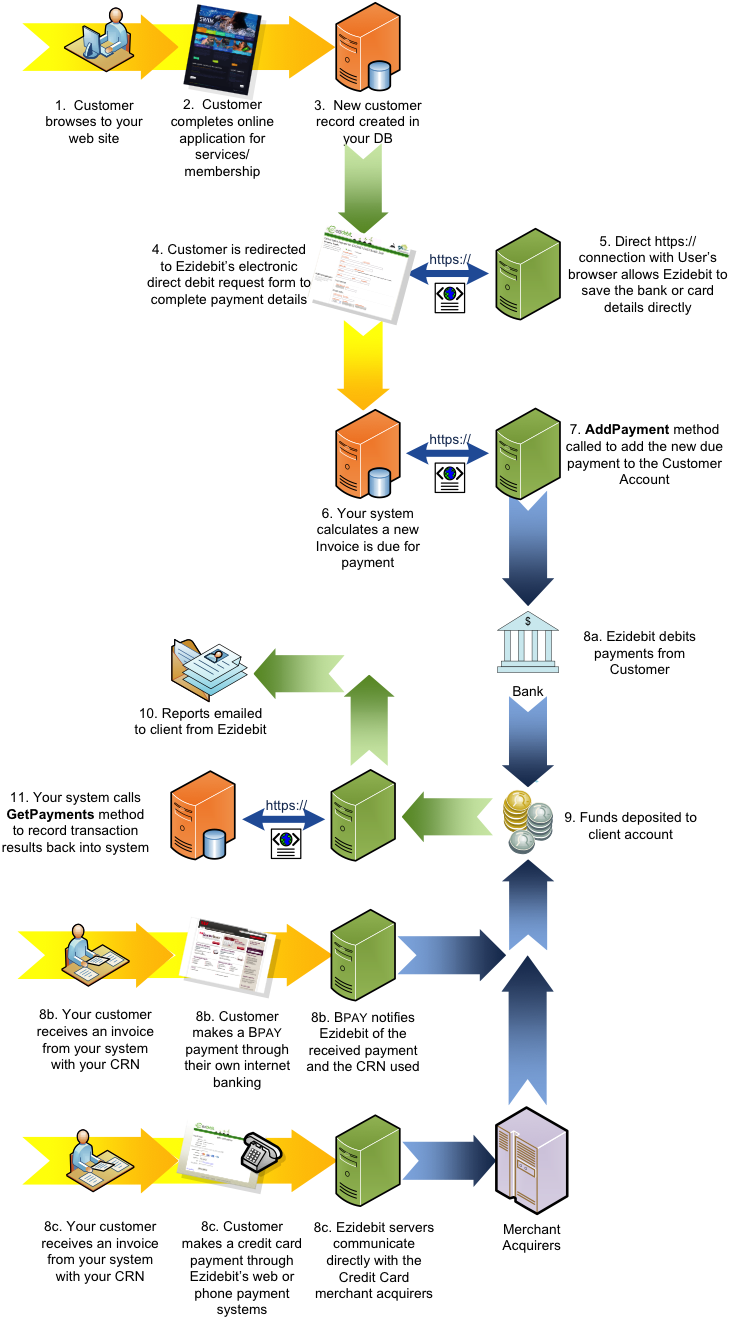

Payment Types

Ezidebit supports the following payment types:

- Direct debit from bank account, credit card and debit card – these payments are processed as Recurring payments. Direct debit payments are processed against customer records that are set up within Ezidebit’s system;

- Real time credit card and debit card payments – these payments are processed in real time as web payments or phone payments. Real time payments are considered as ‘unknown payer’ transactions within Ezidebit’s system. The payment reference supplied with the payment is typically used by the client to identify the payer;

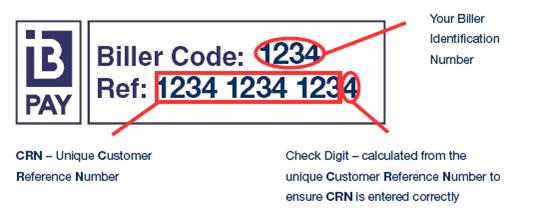

- BPAY – customers are able to initiate a BPAY payment to billers via their internet banking facility. BPAY payments are considered as ‘unknown payer’ transactions within Ezidebit’s system. The CRN provided for the transaction is used by the client to identify the payer.

Creating Customers

Customers are created in Ezidebit’s system to facilitate direct debit payments from a bank account, credit card or debit card. In addition, a real time credit card payment can be processed as a tokenised payment using stored credit card details.

Customers added for direct debit payments must complete an approved Direct Debit Request in one of the following formats:

- Electronic Direct Debit Request (eDDR)

- Paper Direct Debit Request (provided by Ezidebit with live account set up)

- Customised online sign up page, subject to approval by Ezidebit prior to go live

Customers can be added to Ezidebit’s system via the following mechanisms:

- eDDR;

- Web service (requires use of embeddable widget or a client side method for capture of bank account/credit card details)

- Javascript API method.

These options are outlined in the sections below.

eDDR

Description

The Electronic Direct Debit Request (eDDR) form is a single web based form designed to capture Direct Debit Request authorisations and create the payer, and (optionally) their payment schedule, in Ezidebit’s system. The eDDR provides an authorisation for Ezidebit clients that deal with their own customers remotely, rather than in a face-to-face manner. It also reduces the management and handling of paperwork, improving security, and assisting in removing PCI-DSS obligations from Ezidebit’s clients.

Appearance

Through Ezidebit Online, you can customise the look and feel of the eDDR page so that it is more aligned to your own branding with elements such as brand colours and logos. This can be done through the Web Page Configuration option in the Admin menu.

The following page displays how the default standard Scheduled Payment (eDDR) page may look.

Use Cases

Payment templates can be set up in Ezidebit Online, which can provide a convenient eDDR URL and will direct to your customers to the prepared payment plan. They only need to fill in their particulars and payment details - one-off amount and/or recurring debits as well as frequency of payments are pre-filled into the submission form. The following are examples of generated URLs when set up by the template.

Scenario 1 - Customer signs up to become a member for a fitness centre for a membership fee of AU$100 and a monthly fee of AU$50:

If you do not need to collect any information of your own, a standard hyperlink can be prepared to give out to your customers to sign-up online and become a member. This hyperlink can be provided from your website, or within an email. A sign-up page displays to capture relevant customer information. They will enter their name, address, phone number, bank account or credit card details, etc., review the terms and conditions, and submit the form. This creates the customer within Ezidebit’s system.

Where you want to capture some preliminary data on your website, for example a customer browses to your web site and decides to sign-up online to become a member for a membership fee of AU$100 and a monthly fee of AU$50, additional parameters can be passed into the eDDR URL:

A sign-up page on your website displays to capture relevant customer information. (name, address, phone number, etc.). The details that have already been entered by the customer can be passed in to the eDDR form so that the customer is not required to re-type them. The customer is then directed to the eDDR form to enter their bank account or credit card details, review the terms and conditions and select submit, which creates the customer within Ezidebit’s system. The web site user can then be redirected back to your website with additional data about the debit.

Scenario 2 - Pay an invoice over a number of instalments

A customer is paying you an invoice amount of AU$1,000. He signs up to pay this invoice over 10 monthly instalments of AU$100.

Scenario 3 - Make a regular donation to a charity

A donor browses to your web site and decides to donate AU$50. Further, the donor wants to continue donating AU$10 on a fortnightly basis.

Structure

The eDDR form is available at the following URLs. Your account specific URL is available from Ezidebit Online in Web Page Configuration under the Admin menu.

The URL of the LIVE (Production Environment) eDDR is:

https://secure.ezidebit.com.au/webddr/

The URL of the TEST (Sandbox Environment) eDDR is:

https://demo.ezidebit.com.au/webddr/

The form allows data to be provided to it through GET and POST methods. Examples of each are outlined below.

GET METHOD

As demonstrated in the scenario links above, if you do not need to collect any information of your own, a standard hyperlink can be prepared to give out to your customers. This hyperlink can be provided from your website, or within an email.

<form action="https://secure.ezidebit.com.au/webddr/Request.aspx?a=51172E35-1B77-41DF-2007-0EE14CB27262" method="post">

<input type="hidden" name="urefLabel" value="Invoice Number" />

<label for="uref">Invoice Number</label>

<input type="text" name="uref" />

<label for="<td colspan="3" style="background-color:#F8F8F8; font-style:italic;">">First Name</label>

<input type="text" name="<td colspan="3" style="background-color:#F8F8F8; font-style:italic;">" />

<label for="lname">Last Name</label>

<input type="text" name="lname" />

<label for="email">Email</label>

<input type="text" name="email" />

<input type="hidden" name="debits" value="2" />

<input type="hidden" name="tamount" value="400.00" />

<input type="submit" value="Go!!!!" />

</form>

POST METHOD

A form can be used to collect some preliminary information and then submit that data to the eDDR form. The following scenario covers a customer filling out some information on your own website, and then forwarding them to Ezidebit’s eDDR to finish entering bank details, etc.

General Guidelines

Below are a number of important points that you should keep in mind when using the Electronic Direct Debit Request:

- For security purposes no bank account or credit card information can be passed into, nor will be passed back from the eDDR form;

- When parameters are passed to the form, the field that they are passed into is disabled and not editable by the customer. This is based on the assumption that if a client is supplying data for a field, there is a specific reason for the value and it is not desirable to have a customer override the data. If you do want to allow customers to override the pre-filled values that are passed to the form you can pass the ed=1 parameter to the form and it will enable all fields on the form and simply use data passed to it as a default;

- The eDDR cannot be used to modify existing payment details (e.g. change bank account details);

- When the query string is incorrect or the client record is not active, “Direct Debit Request Error” page will be displayed when the URL is used;

- When the Client is not set up to accept either Bank Account or Credit Cards, the corresponding payment method will not be displayed on the eDDR;

- When the Client is not set up for SMS reminders, the SMS tick box will be unavailable on the eDDR.

Input Values

Below is a list of all of the possible query string parameters that can be used with the eDDR URL to initialise the form.

| Parameter | Form Control | Format | Example |

|---|---|---|---|

| uRefLabel |

“Your Reference” Label value. * Note that not providing this parameter will show the default label of “Your Reference” |

String

(80 Char maximum) |

Invoice Number |

| uRef |

Your Reference field value. This value must be unique across all customers associated with the client account Where a value is passed in to the eDDR form for the ‘Your Reference’ field (uRef parameter), a check will be done to see if the value already exists for a customer record in the client account with Ezidebit. Where the value already exists, the value will not be populated and the field will become editable. |

String

(50 Char maximum) |

LWB:12029 |

| nouRef |

This will hide the reference field and produce a generic reference upon submission |

Numeric

(Number 1 only) |

1 |

| businessOrPerson |

Specifying this parameter will display data entry fields of First Name and Last Name for a Person, or Company Name for a Company. |

Number |

1 - Person 2 - Business *Note that not providing this parameter will show a drop-down menu for the user to select Person or Business options by default. |

| fName |

First Name |

String

(30 Char maximum) |

Joe |

| lName |

Last Name |

String

(60 Char maximum) |

Bloggs |

|

String

(255 Char maximum) |

example@example.com |

||

| noClientEmail |

Copy of the agreement will not be emailed to Client |

Numeric

(Number 1 only) |

1 |

| mobile |

Mobile No |

Numeric

(10 digits beginning with '04’) |

0400 000 000 |

| nosms |

This will hide the SMS notification option if set to 1 |

Numeric |

1 |

| sms |

This enables the SMS notification option to be set to Yes by default. The customer then can untick it if required |

Numeric |

1 |

| addr | Address line 1

* Note required if Address line 2 is present |

String

(30 Char maximum) |

123 Fake St |

| addr2 | Address line 2 |

String

(30 Char maximum) |

Apartment 03-05 |

| suburb | Suburb |

String

(20 Char maximum) |

Milton |

| state | State |

String

(3 Char maximum) |

QLD |

| pCode | Postcode |

Numeric

(4 digits exactly) |

4064 |

| debits |

This determines which options are available in the Debit Arrangement area: 1 - Show only “Once Off Debit” 2 - Show only “Regular Debits” 4 - Show only “Triggered Debit Authorization” * Note that not providing this parameter will show Once Off Debits AND Regular Debits by default |

Numeric

(Numbers 1 - 4) |

2 |

| oAmount |

This will set the value of the Debit Amount for the Once Off Debit option * Note you can include this parameter with different values more than once in the query string, or alternately provide a comma separated list as the value. By providing more than one value for this parameter it will change the amount field to a drop-down list of values for the customer to select. For example: |

Numeric or Comma separated list of numeric values. (Decimal number of ddd.cc) |

oAmount=200.00 |

| oDate |

This will set the value of the Date field for the Once Off Debit option. If a valid date is passed then the debit date will be set to that date (or the next business day if the date falls on a weekend). If a day of week value is passed then the debit date will be calculated to be the next possible occurrence of that particular day of the week, e.g. submitting WED on a Wednesday sets the debit date as that day, submitting MON on a Wednesday sets the debit date as the following Monday. If an integer value is passed then the debit date will be calculated as the current date plus the integer value number of days - e.g. passing 0 sets the debit date to today , passing 1 sets the debit date to tomorrow, etc. * Note that a valid parameter will always shift the debit date to a Monday if the supplied or calculated date falls on a weekend. |

Date (dd/mm/YYYY)

OR Day of week (MON - FRI) OR In x days (Numbers 0-30) |

27/08/2010

OR FRIOR 14 (will be two weeks from today) |

| rAmount |

This will set the value of the Debit Amount for the Regular Debits option. * Note you can include this parameter with different values more than once in the query string, or alternately provide a comma-separated list as the value. By providing more than one value for this parameter it will change the amount field to a drop-down list of values for the customer to select. For example: |

Numeric or Comma separated list of numeric values. (Decimal number of ddd.cc) |

rAmount=200.00 |

| rDate |

This will set the value of the Date field for the Regular Debits option. If a valid date is passed then the debit date will be set to that date (or the next business day if the date falls on a weekend). If a day of week value is passed then the debit date will be calculated to be the next possible occurrence of that particular day of the week, e.g. submitting WED on a Wednesday sets the debit date as that day, submitting MON on a Wednesday sets the debit date as the following Monday. If an integer value is passed then the debit date will be calculated as the current date plus the integer value number of days, e.g. passing 0 sets the debit date to today , passing 1 sets the debit date to tomorrow, etc. * Note that a valid parameter will always shift the debit date to a Monday if the supplied or calculated date falls on a weekend. |

Date (dd/mm/YYYY)

OR Day of week (MON - FRI) OR In x days (Numbers 0-30) |

27/08/2010

OR FRIOR 14 (will be two weeks from today) |

| aFreq |

This allows you to choose which debit frequencies are available within the Frequency select list in the Regular Debits Area. Multiple frequencies can be selected by adding the values of the frequencies that you want to display from the list below: 1 - Weekly 2 - Fortnightly 4 - Monthly 8 - Every four weeks 16 - Quarterly 32 - Half Yearly 64 - Yearly E.g. To show either weekly or monthly the value of this parameter would be determined by: Weekly (1) + Monthly (4) = 5 * Note that not providing this parameter will show only Weekly , Fortnightly or Monthly frequencies by default. |

Number |

7 This would display Weekly, Fortnightly |

| freq |

This will set the value of the Frequency field in the Regular Debits area. 1 - Select Weekly 2 - Select Fortnightly 4 - Select Monthly 8 - Select Every four weeks 16 - Select Quarterly 32 - Select Half Yearly 64 - Select Yearly |

Number |

4 This would set Monthly as the frequency |

| aDur |

This allows you to choose which duration options are available within the Duration select list in the Regular Debits area. Multiple options can be selected by adding the values of the durations that you want to display from the list below: 1 - Ongoing 2 - Total Amount 4 - Total Payments E.g. To show either Total Amount or Total Payments the value of this parameter would be determined by: Total Amount (2)+Total Payments (4)= 6 * Note that not providing this parameter will show all three options by default. |

5 |

|

| dur |

This will set the value of the Duration field in the Regular Debits area 1 - Ongoing 2 - Total Amount 4 - Total Payments |

Number |

4 This would set Total Payments as the Duration |

| tAmount |

This will set the value of the Total Payment Amount for the Regular Debits option * Note you can include this parameter with different values more than once in the query string, or alternately provide a comma separated list as the value. By providing more than one value for this parameter it will change the amount field to a drop-down list of values for the customer to select. For example: |

Numeric or Comma separated list of numeric values. (Decimal number of ddd.cc) |

tAmount=200.00 |

| tPay |

This will set the value of the Total Payments field in the Regular Debits area |

Number |

10 |

| method |

This will show only the selected payment method. 1 - Bank Account Only 2 - Credit Card Only * Note that not providing this parameter will show both payment options by default |

Number |

2 |

| ed |

This affects any fields set by passing values into them through query string or form parameters. By passing in a value for ed it will make any field where the value has been set editable by your customer. This is typically used where you want to provide defaults, but still allow the customer to change anything of their choosing. |

Number |

1 |

|

a |

The client public key or identifier compound (DGR Hash) |

GUID or Hex String |

1C1C7315-ECD8-47C1-59C9-EC5D04EEDCBF or 0x3231313021504BF347454E |

| callback |

Specifying this parameter forces the eDDR form to redirect the user to the URL specified in this parameter after the form submission is completed. The redirection will include the fields that contain the customer’s information as described in section below of this document. * Note that the redirection will use the HTTP Method specified in the cMethod parameter. If the cMethod parameter is not included, it will default to GET. ** See section below, Return Values & Response Code, for specific details about the function of this parameter. |

String

(255 Char maximum) |

http://example.com/formcompleted.htm |

| cMethod |

The HTTP method you would like Ezidebit to use when it submits the customer data to the callback URL specified in the callback parameter. * Note that by default this parameter is set to GET. If no value is provided for the callback parameter then this parameter will be ignored ** See section below, Return Values & Response Code, for specific details about the function of this parameter. |

String

(4 char maximum) |

GET

OR POST |

| dishonAction |

Presets the dishonour action for the contract on submission. DISHONOUR - No attempt is made to recover failed payment. Remainder of contract defined schedule continues unchanged (default). |

String | RESCHEDULE_NEXT |

CALLBACK METHOD:

If you would like to receive the information we collect from the customer after they have filled out our form, you can request a callback using either of the following methods.

<input type="hidden" name="callback" value="http://example.com/complete.htm" />

<input type="hidden" name="cmethod" value="get" />

Callback using GET

This will allow you to collect all fields in the “Customer Details” section including our reference. Just add the callback and cMethod parameters to the link or form:

https://demo.ezidebit.com.au/webddr/Request.aspx?a=51172E35-1B77-41DF-2007-0EE14CB27262&debits=3&method=2&callback=http://example.com/complete.htm&cmethod=get

<input type="hidden" name="callback" value="http://example.com/complete.htm" />

<input type="hidden" name="cmethod" value="post" />

Callback using POST

This will allow you to collect all fields in the “Customer Details” section including our reference. Just add the callback and cMethod parameters to the link or form:https://demo.ezidebit.com.au/webddr/Request.aspx?a=51172E35-1B77-41DF-2007-0EE14CB27262&debits=3&method=2&callback=http://example.com/complete.htm&cmethod=post

Return Values & Response Codes

The following is a list of values that will be returned to you via either of the callback methods.

| Value | Description |

|---|---|

| uref | Your Customer Reference (YourSystemReference) |

| cref | Ezidebit's Customer Reference (EzidebitCustomerID) |

| fname | First Name (if the customer is a Person and not a Business) |

| lname | Last Name (or company name when a Business) |

| Email address | |

| mobile | Mobile number |

| addr | Address line 1 |

| addr2 | Address line 2 |

| suburb | Suburb |

| state | State |

| pcode | Postcode |

| rdate | The date of the first recurring payment |

| ramount | The regular debit amount |

| freq | The frequency that debits will occur on (values in parameters table) |

| odate | The date of any one-off payment |

| oamount | The amount of a one-off payment |

| numpayments | The number of payments a schedule is restricted to |

| totalamount | The total amount that a schedule is restricted to |

| method | The method of payment chosen by the Customer |

Note: Only customers that were successfully added to the Ezidebit system will be returned via the callback.

The successfully created Payer details can be found in the Client’s Ezidebit Online Portal.

AddCustomer

URL

| URL of Web Services | |

| Production (LIVE) | https://api.ezidebit.com.au/v3-5/nonpci |

| Sandbox (TEST) | https://api.demo.ezidebit.com.au/v3-5/nonpci |

Description

This method creates a new customer record in the Ezidebit database from which you will be able to schedule direct debit payments or use a stored credit card for tokenised real time payments. It is important to note the following when creating customers:

- This method will create the customer record and it will set the new customer record to a non-processing status. Credit Card or Bank Account details will need to be provided (typically through the Account Widget) before debits can be taken from the customer;

- Each customer may have only one payment method recorded against them. This payment method will be either a bank account or a credit card. When a scheduled payment becomes due, it will be debited from the payment method recorded against that customer at that point in time. Each time the payment method is updated, it will override any existing payment method that the customer has;

- Customers have a single payment schedule associated with them. It is possible to insert additional “manual” payments into an existing schedule;

- If a customer has a status that does not allow processing of payments (Hold or Cancelled Status) at the time that a scheduled payment becomes due, then the payment will be removed from their schedule, but will not be debited from their payment method.

When using this method to save a customer as part of an online sign up, you MUST adhere to the requirements set out in the BECS Compliance section.

Request Parameters

<soapenv:Envelope xmlns:soapenv="http://schemas.xmlsoap.org/soap/envelope/" xmlns:px="https://px.ezidebit.com.au/">

<soapenv:Header />

<soapenv:Body>

<px:AddCustomer>

<px:DigitalKey>00000000-0000-0000-0000-000000000000</px:DigitalKey>

<px:YourSystemReference>102</px:YourSystemReference>

<px:YourGeneralReference>102</px:YourGeneralReference>

<px:LastName>Stevens</px:LastName>

<px:FirstName>John</px:FirstName>

<px:AddressLine1>123 Smith St</px:AddressLine1>

<px:AddressLine2>Level 2</px:AddressLine2>

<px:AddressSuburb>Wilston</px:AddressSuburb>

<px:AddressState>QLD</px:AddressState>

<px:AddressPostCode>4051</px:AddressPostCode>

<px:EmailAddress>jstevens@example.com</px:EmailAddress>

<px:MobilePhoneNumber>0400123456</px:MobilePhoneNumber>

<px:ContractStartDate>2011-03-01</px:ContractStartDate>

<px:SmsPaymentReminder>NO</px:SmsPaymentReminder>

<px:SmsFailedNotification>NO</px:SmsFailedNotification>

<px:SmsExpiredCard>NO</px:SmsExpiredCard>

<px:Username>WebServiceUser</px:Username>

</px:AddCustomer>

</soapenv:Body>

</soapenv:Envelope>

| Parameter Name | Description | Format | Example |

|---|---|---|---|

| DigitalKey (Required) |

The 36 character Digital Key supplied to you by Ezidebit to identify your business |

String | 8591BFD4-E7C8-4284-84F7-E6C419114FA8 |

| YourSystemReference |

A unique system identifier for the customer (e.g. GUID or your primary key). This is typically a unique identifier for the account/member/contract in your application and is used in a system-to-system manner. The purpose of this reference is to allow you to access your Customer’s details via Ezidebit’s web services using your own reference numbers, without the need to record an Ezidebit reference in your system. |

String

(Max 50 char) |

563445878985432x76 |

| YourGeneralReference |

A secondary unique reference for the customer. Where system based identifiers (YourSystemReference) can be complex numbers, this is designed to be a simpler, human-friendly number. You may use a GUID to create the system-to-system link with YourSystemReference, and choose to include a membership ID, or such in this field. If no value is supplied for this field it will default to 'LastnameFirstnameYYYYmmDDhhMM’. |

String

(Max 50 char) |

101 |

| LastName (Required) |

Where the customer is an individual, the Customer’s surname should be supplied. Where the customer is a business or organisation, the name of the entity should be supplied. |

String

(Max 60 char) |

Smith |

| FirstName |

Customer’s first name (for individuals) If this is left blank, the customer will be flagged in Ezidebit’s system as a business. |

String

(Max 30 char) |

Joe |

| AddressLine1 |

The first line of the Customer’s physical address. * Note required if customerAddress2 is present |

String

(Max 30 char) |

123 Smith St |

| AddressLine2 |

The second line of the Customer’s physical address |

String

(Max 30 char) |

Level 4 |

| AddressSuburb |

The Suburb of the Customer’s physical address. |

String

(Max 20 char) |

Wilston |

| AddressState |

The State of the Customer’s physical address. |

String

(Max 3 char) |

QLD |

| AddressPostCode |

The Postcode of the Customer’s physical address. |

String

(Max 4 digits) |

4051 |

| EmailAddress |

Customer’s email address |

String

(Max 255 char) |

joesmith@example.com |

| MobilePhoneNumber |

Customer’s mobile telephone number. NB - for Australian Customers the mobile phone number must be 10 digits long and begin with '04’. For New Zealand Customers the mobile phone number must be up to 12 digits long and begin with '02’ |

String

(Max 12 char) |

0400123456 |

| ContractStartDate (Required) |

The date that the customer signed the Direct Debit Request Service Agreement. Must be formatted as yyyy-MM-dd |

String yyyy-MM-dd | 2010-12-22 |

| SmsPaymentReminder (Required) |

Optionally send an SMS to the customer reminding them of their upcoming scheduled debits. |

String

YES or NO |

YES |

| SmsFailedNotification (Required) |

Send an SMS to the customer notifying them if their debit fails. For a valid mobile number an SMS is sent regardless of the parameter |

String

YES or NO |

YES |

| SmsExpiredCard (Required) |

Optionally send an SMS to the customer notifying them if their recorded credit card is due to expire. |

String

YES or NO |

YES |

| Username |

Optionally record the user in your system that is executing this action |

String

(Max 50 char) |

Webuser |

<s:Envelope xmlns:s="http://schemas.xmlsoap.org/soap/envelope/">

<s:Body>

<AddCustomerResponse xmlns="https://px.ezidebit.com.au/">

<AddCustomerResult xmlns:i="http://www.w3.org/2001/XMLSchema-instance">

<Data xmlns:a="http://schemas.datacontract.org/2004/07/Ezidebit.PaymentExchange.V3_3.DataContracts ">

<a:CustomerRef>123456</a:CustomerRef>

</Data>

<Error>0</Error>

<ErrorMessage i:nil="true" />

</AddCustomerResult>

</AddCustomerResponse>

</s:Body>

</s:Envelope>

Response

- The <Data> field in the AddCustomer response will be either:

- A CustomerRef value containing positive non-zero integer that is the value of the EziDebitCustomerID that has been allocated to the successfully created Customer;

- Empty - When the Data field is empty, it indicates that the update was not successful. You should check the value of the Error field. If an error has occurred, it will be indicated by a non-zero value in the Error field, with a text descriptor in the ErrorMessage field.

SaveCustomer

URL

| Endpoint | |

| Production (LIVE) | https://api.ezidebit.com.au/V3-5/public-rest |

| Sandbox (TEST) | https://api.demo.ezidebit.com.au/V3-5/public-rest |

| Javascript File | https://static.ezidebit.com.au/javascriptapi/js/ezidebit_2_0_0.min.js |

Description

The SaveCustomer Javascript method will add a customer record to the Ezidebit database. This request is used when credit card details are being collected from the customer and stored by Ezidebit for later processing of a 'batched’ transaction using direct debit, or a tokenised real time payment. When submitting the customer with credit card details, there are two scenarios that can occur:

- If the customer details and card information are passed but with no payment amount then the customer is stored with the credit card information and but no charge to the credit card is processed;

- If the customer details, card information and payment amount are passed then the customer is charged in real-time and the customer and payment information are stored for later use.

When using this method, credit card details are securely transmitted to Ezidebit – they are never sent to your own servers or database. This ensures the card details are handled in a PCI compliant manner.

When credit card deatils are being entered using this method, you must display the relevant card scheme logo as the card is being entered. For more information please see the Displaying Credit Card Logos section.

When using this method to save a customer as part of an online sign up, you MUST adhere to the requirements set out in the BECS Compliance section.

$(document).ready(function () {

eziDebit.init("YOUR_PUBLIC_KEY", {

submitAction: "SaveCustomer",

submitButton: "btnSubmit",

submitCallback: displaySubmitCallback,

submitError: displaySubmitError,

customerFirstName: "txtFirstName",

customerLastName: "txtLastName",

customerReference: "hidReference",

customerAddress1: "txtAddress1",

customerAddress2: "txtAddress2",

customerSuburb: "txtSuburb",

customerState: "txtState",

customerPostcode: "txtPostcode",

customerEmail: "txtEmail",

customerMobile: "txtMobile",

nameOnCard: "txtNameOnCard",

cardExpiryMonth: "txtExpiryMonth",

cardExpiryYear: "txtExpiryYear",

CardCCV: "txtCCV",

paymentAmount: "hdnAmount",

paymentReference: "hdnPaymentRef",

}, endpoint);

Requests

| Parameter Name | Description | Format | Example |

|---|---|---|---|

| submitAction (required) |

This should always be SaveCustomer for this function |

String | SaveCustomer |

| submitButton (required) |

The client side element name of the button to submit the form (usually an input of type submit or button) |

String | btnSubmit.ClientID |

| submitCallback (required) |

The method name of some client side code to execute when the operation completes successfully. A useful action would be to store the Ezidebit customer ID into a hidden field and then to submit the form to your server |

Function | SubmitCallback |

| submitError (required) |

The method name of some client side code to execute when the operation failed, or the form failed validation. Generally, this should be an action that takes an error message and displays it on the page |

Function | ErrorCallback |

| customerFirstName |

The client side element name that is capturing the customer first name (usually an input of type text) |

String

(Max 30 char) |

txtFirstName |

| customerLastName (required) |

The client side element name that is capturing the customer last name (usually an input of type text) |

String

(Max 60 char) |

txtLastName |

| customerReference |

The client side element name that is capturing your unique customer reference (usually an input of type hidden). This is optional |

String

(Max 50 char) |

hidReference |

| customerAddress1 |

The client side element name that is capturing the customer address line 1 (usually an input of type text). This is optional * * Note required if customerAddress2 is present |

String

(Max 30 char) |

txtAddress1 |

| customerAddress2 |

The client side element name that is capturing the customer address line 2 (usually an input of type text). This is optional |

String

(Max 30 char) |

txtAddress2 |

| customerSuburb |

The client side element name that is capturing the customer suburb (usually an input of type text). This is optional |

String

(Max 20 char) |

txtSuburb |

| customerState |

The client side element name that is capturing the customer state (usually an input of type text). This is optional |

String

(Max 3 char) |

txtState |

| customerPostcode |

The client side element name that is capturing the customer postcode (usually an input of type text). This is optional |

String

(Max 4 digits) |

txtPostcode |

| customerEmail |

The client side element name that is capturing the customer email address (usually an input of type text) |

String

(Max 255 char) |

txtEmail |

| customerMobile |

The client side element name that is capturing the customer mobile number (usually an input of type text). This is optional. NB - for Australian Customers the mobile phone number must be 10 digits long and begin with '04’. |

String

(Max 12 char) |

txtMobile |

|

nameOnCard

(required if storing credit card) |

The client side element name that is capturing the customer’s name as it appears on their card (usually an input of type text) |

String

(Max. 100 char) |

txtNameOnCard |

|

cardNumber

(required if storing credit card) |

The client side element name that is capturing the customer’s card number (usually an input of type text) |

String

(Numeric Max 16 digits) |

txtCardNumber |

|

cardExpiryMonth

(required if storing credit card) |

The client side element name that is capturing the customer’s card month expiry date (usually an input of type text) |

Numeric

(2 digits) |

txtExpiryMonth |

|

cardExpiryYear

(required if storing credit card) |

The client side element name that is capturing the customer’s card year expiry date (must be 4 digits, usually an input of type text) |

Numeric

(4 digits) |

txtExpiryYear |

|

CardCCV

(Required for real-time processing only) |

The client side element name that is capturing the CCV number of the card (usually an input of type text) |

Numeric

(4 digits) |

txtCCV |

| paymentAmount |

The client side element name that is capturing the amount. Usually, this would be a hidden field that your server has already generated. 0 must be passed for this element if you do not want to perform a realtime payment from the card. If a non-0 integer is passed for this element, the customers credit card will be charged that amount |

Numeric | hdnAmount |

| paymentReference

(Required for real-time processing only) |

The client side element name that is capturing a payment reference number. This may be a hidden field that your server has already generated. |

String

(Max 50 char) |

hdnPaymentRef.ClientID |

Response

If the transaction and storing of the customer is unsuccessful, the standard error message is reported back and the error handler is called as normal. If the transaction is successful, the data object is returned containing the following parameters:

| Parameter Name | Description | Format | Example |

|---|---|---|---|

| Data.BankReceiptId |

The receipt ID generated by the bank. You can use this ID to confirm a payment has been approved |

Integer | 237817 |

| Data.CustomerRef |

The unique reference number stored in the Ezidebit database that corresponds to the customer. |

Integer | 327873 |

| Error |

The error response code. This will be 0 for a successful API call. |

Numeric | 0 |

| ErrorMessage |

A short description of the Payment Result code that you may choose to display to the user. |

String | null |

Complete Examples

We have a sample pack of HTML pages that you can download or check out a few implementations:

View the source or download the files to see how they work.

Please note: If you enter something into the Payment Reference field and a Payment Amount is anything other than $0, a charge will be attempted on the card and then customer saved. If the Payment Reference and Amount is left blank, no attempt will be made to charge the card but the customer and the entered card details will be saved. CCV is not a mandatory field in this form because it is not needed to save the card details, but if the card is to be charged, CCV becomes mandatory.

Real-time Credit Card Transaction Response Codes

Please refer to Credit Card Response Codes for a list of Transaction Response Codes

Error Response Code

Please refer to Error Codes for a list of Error Codes.

SaveCustomerAccount

URL

| Endpoint | |

| Production (LIVE) | https://api.ezidebit.com.au/V3-5/public-rest |

| Sandbox (TEST) | https://api.demo.ezidebit.com.au/V3-5/public-rest |

| Javascript File | https://static.ezidebit.com.au/javascriptapi/js/ezidebit_2_0_0.min.js |

Description

The SaveCustomerAccount method will store customer information and it will accept customer bank account information including the account name, BSB and account number.

Note that the customer is not charged. Instead, their account details are stored on file for later use.

When using this method to save a customer as part of an online sign up, you MUST adhere to the requirements set out in the BECS Compliance section.

Requests

The SaveCustomerAccount method can be called using the init method by using the public key and the following parameters:

| Parameter Name | Description | Format | Example |

|---|---|---|---|

| submitAction (required) |

This should always be SaveCustomerAccount for this function |

String | SaveCustomerAccount |

| submitButton (required) |

The client side element name of the button to submit the form (usually an input of type submit or button) |

String | btnSubmit.ClientID |

| submitCallback (required) |

The method name of some client side code to execute when the operation completes successfully. A useful action would be to store the Ezidebit customer ID into a hidden field and then to submit the form to your server |

Function | SubmitCallback |

| submitError (required) |

The method name of some client side code to execute when the operation failed, or the form failed validation. Generally, this should be an action that takes an error message and displays it on the page |

Function | ErrorCallback |

| customerFirstName |

The client side element name that is capturing the customer first name (usually an input of type text) |

String

(Max 30 char) |

txtFirstName |

| customerLastName (required) |

The client side element name that is capturing the customer last name (usually an input of type text) |

String

(Max 60 char) |

txtLastName |

| customerReference |

The client side element name that is capturing your unique customer reference (usually an input of type hidden). This is optional |

String

(Max 50 char) |

hidReference |

| customerAddress1 |

The client side element name that is capturing the customer address line 1 (usually an input of type text). This is optional * * Note required if customerAddress2 is present |

String

(Max 30 char) |

txtAddress1 |

| customerAddress2 |

The client side element name that is capturing the customer address line 2 (usually an input of type text). This is optional |

String

(Max 30 char) |

txtAddress2 |

| customerSuburb |

The client side element name that is capturing the customer suburb (usually an input of type text). This is optional |

String

(Max 20 char) |

txtSuburb |

| customerState |

The client side element name that is capturing the customer state (usually an input of type text). This is optional |

String

(Max 3 char) |

txtState |

| customerPostcode |

The client side element name that is capturing the customer postcode (usually an input of type text). This is optional |

String

(Max 4 digits) |

txtPostcode |

| customerEmail |

The client side element name that is capturing the customer email address (usually an input of type text) |

String

(Max 255 char) |

txtEmail |

| customerMobile |

The client side element name that is capturing the customer mobile number (usually an input of type text). This is optional. NB - for Australian Customers the mobile phone number must be 10 digits long and begin with '04’. |

String

(Max 12 char) |

txtMobile |

| accountName (required) |

The client side element name that is capturing the customer bank account name (usually an input of type text). |

String | txtAccountName |

| accountBSB (required) |

The client side element name that is capturing the customer BSB number (usually an input of type text) |

String

(Numeric max 6 characters, do not include the dash) |

txtAccountBSB |

| accountNumber (required) |

The client side element name that is capturing the customer account number (usually an input of type text) |

String

(Numeric max 9 characters) |

txtAccountNumber |

Response

If the transaction and storing of the customer is unsuccessful, the standard error message is reported back and the error handler is called as normal. If the transaction is successful, the data object is returned containing the following parameters:

| Parameter Name | Description | Format | Example |

|---|---|---|---|

| CustomerRef |

The unique reference number stored in the Ezidebit database that corresponds to the customer. |

Integer | 327873 |

Complete Examples

We have a sample pack of HTML pages that you can download or check out the SaveCustomerBankAccount.htm one on its own. View the source or download the files to see how they work.

Maintaining Account Details

Embeddable Widget

The Account Widget should be used for maintenance of bank account/credit card details for existing customers. It is possible to create customers in the Ezidebit Management Systems without Bank Account or Credit Card Details recorded against them, and they will be set to a non-processing Hold Status until the appropriate payment source is provided. This allows businesses to create new customers through integrated methods, without the need for their system to handle sensitive data, instead using Ezidebit’s widget to handle that data directly.

Description

The Account Widget is delivered over a Secure Sockets Layer (SSL) HyperText Transfer Protocol (HTTP) connection, otherwise known as HTTPS. This ensures that communication between your application or web browser is secure and encrypted.

When the Account Widget is included in a web-based application, as described in this document, the communications occur directly between the user’s browser and the Ezidebit web servers, and there is no communication between your application or database server and the Ezidebit web servers.

When the Account Widget is included in a standalone application that is installed on the user’s computer, the user’s computer will need to communicate with the Ezidebit web servers via https, and as such you will need to ensure that you include the appropriate Secure Sockets Libraries in your application to facilitate this.

Ezidebit’s SSL Certificates are signed by the DigiCert High Assurance CA-3 Intermediate Certificate, which is a commonly embedded root certificate on most platforms. If your library or program does not recognise the Certification Authority, you may also need to install the Root Certificate with your application. You can obtain the appropriate root certificate and instructions on how to install it directly from DigiCert (https://www.digicert.com/digicert-root- certificates.htm)

Use Cases

The Ezidebit Management Systems maintain only one payment source (bank account or credit card) for each Customer (payer). When you change the Bank Account or Credit Card on record, it will record this change at the Customer level and apply the new credentials for all future payments from that Payer until such a point as they are changed again.

Structure

The Account Widget is a web-based form. You can access the form through either GET or POST methods, via a secured HTTPS call. The live and test widgets are located at the following addresses.

The URL of the LIVE widget is:

https://widget.ezidebit.com.au/account/

The URL of the TEST widget is:

https://widget.demo.ezidebit.com.au/account/

The base URL without any actions will return an Error 404. You will need to provide the actions with the widget. The widget currently has two actions available, view and edit. These actions are appended to the URL before the query string parameters. For example:

To view account details:

https://widget.demo.ezidebit.com.au/account/view?dk=49A67D1B-DF3F-4013-B13A-A5E9E41E8873&cr=99999

To edit account details:

https://widget.demo.ezidebit.com.au/account/edit?dk=49A67D1B-DF3F-4013-B13A-A5E9E41E8873&cr=99999

CALLBACK METHOD

If you would like to redirect customer after they have filled out our form and successfully submitted, you can request a callback by providing link in the callback parameter.

Embed Using iFrame

To use the account widget within your application or website it must be rendered in its own container. Typically, you will achieve this in a website by providing an iframe to position the widget where you wish.

The source URL for the iframe should be dynamically generated by your application to ensure that the correct customer is

loaded through the query string parameters, as well as any visual component you wish to control. As a minimum, you must

supply your digital key and either of the customer reference identification parameters (er= or cr=).

Input Values

Below is a list of all of the possible query string or POST parameters that can be passed to the widget to initialise the state of the form. Note that the parameters in bold may be required.

| Parameter | Description | Format | Example |

|---|---|---|---|

| dk (required) |

Digital Key The integration Digital Key supplied to the client by Ezidebit. |

String

(36 chars) |

49A67D1B-DF3F-4013-B13A-A5E9E41E8874 |

|

er

(*required if cr parameter is not provided) |

Ezidebit Reference Number The number provided by Ezidebit for the customer. This Ezidebit ID can be used to allow the client system to communicate with Ezidebit using the Ezidebit ID in the case that the client system does not have its own identifier. This value is the same as the EziDebitCustomerID value that is used through other Ezidebit APIs |

Number

(typically 5 to 7 digits long) |

678124 |

|

cr

(*required if er parameter is not provided) |

Client’s Reference Number A unique identifier for this customer that is generated by the client management application. This might be a member ID, order number, GUID or some other identifier. This reference ID can be used in place of the Ezidebit Customer ID to allow the client system to communicate with Ezidebit using its own payer/customer references. This value is the same as the YourSystemReference value used through other Ezidebit APIs |

String

(max 50 chars) |

5363-XXs |

|

E |

Editable

Setting this parameter to 1 will enable users to edit the account details. Providing an e=1 parameter enables an “Edit” button to be displayed at the bottom of the view action. |

Number

(1 char) 0 - View Only 1 - Editable |

0 or 1 |

| callback |

Callback URL Specifying this parameter forces widget to redirect the user to the URL specified in this parameter after the form submission is completed. |

String | http://www.ezidebit.com/ |

|

F |

Font

Sets the font for all text on the widget. |

String

(max 50 chars) |

Trebuchet MS |

| h1c |

Header Colour Sets the colour of the header. Must be a hex code - RRGGBB |

String

(6 chars) |

FF5595 |

| h1s |

Header Size Sets the size of the header. Must be in pixels. |

Number

(in pixels) |

20 |

| lblc |

Label Colour Sets the colour of the labels. Must be a hex code - RRGGBB |

String

(6 chars) |

EB7636 |

| lbls |

Label Size Sets the size of the labels. Must be in pixels. |

Number

(in pixels) |

14 |

| bgc |

Background Colour Sets the background colour of the widget. Must be a hex code - RRGGBB |

String

(6 chars) |

FFFFFF |

| hgl |

Highlight Colour Sets the highlight colour of the widget. This is the predominant colour of the widget. Must be a hex code - RRGGBB |

String

(6 chars) |

1892CD |

| txtc |

Text Colour Sets the colour of all other text on the widget. Must be a hex code - RRGGBB |

String

(6 chars) |

333333 |

| txtbgc |

Textbox Background Colour Sets the background colour of the textboxes. Must be a hex code - RRGGBB |

String

(6 chars) |

FFFFFF |

| txtbc |

Textbox Focus Border Colour Sets the colour of the textbox borders for the currently selected (focus) textbox. Must be a hex code - RRGGBB |

String

(6 chars) |

EB7636 |

Error Codes

The table below outlines the possible error codes that may be returned by the widget.

| Code | Description |

Possible Cause |

| 101 |

Not all required parameters were supplied |

The widget requires at least the digital key (dk) parameter and either the Ezidebit ID (er) or your ID (cr) parameters. |

| 201 |

Could not find a customer with the provided details |

The value of the reference ID parameter (er or cr) does not relate to a customer in the Ezidebit Management System. Check that the customer has been created. |

| 202 |

Invalid Digital Key |

The value of the Digital Key parameter (dk) does not identify a client record in the Ezidebit Management System. Check that the Digital Key that you are using is active and you are calling the correct URL, i.e. you are using a Test digital key for the test widget or a live digital key for the live widget. |

ChangeCustomerPaymentInfo

URL

| Endpoint | |

| Production (LIVE) | https://api.ezidebit.com.au/V3-5/public-rest |

| Sandbox (TEST) | https://api.demo.ezidebit.com.au/V3-5/public-rest |

| Javascript File | https://static.ezidebit.com.au/javascriptapi/js/ezidebit_2_0_0.min.js |

The ChangeCustomerPaymentInfo is a Javascript method that enables you to collect updated bank account or credit card details from customers via your web site. We recommend that you have a secure log in for the customer to access any of their existing information before allowing update of details.

Description

This method allows you to update the billing account details currently held on file by Ezidebit for a customer. This requires an identifier to be passed in to identify the correct customer to be updated.

Note that the customer is not charged. Instead, their account details are stored on file for later use.

This method by default reactivates a customer if on hold status.

Requests

You can call the ChangeCustomerPaymentInfo method by passing the init method a public key followed by an array of arguments. The array parameters include:

| Parameter Name | Description | Format | Example |

|---|---|---|---|

| submitAction (required) |

This should always be ChangeCustomerPaymentInfo for this function |

String | ChangeCustomerPaymentInfo |

| submitButton (required) |

The client side element name of the button to submit the form (usually an input of type submit or button) |

String | btnSubmit.ClientID |

| submitCallback (required) |

The method name of some client side code to execute when the operation completes successfully. A useful action would be to store the Ezidebit customer ID into a hidden field and then to submit the form to your server |

Function | SubmitCallback |

| submitError |

The method name of some client side code to execute when the transaction failed, or the form validation failed. Generally this should be an action that takes an error message and displays it on the page |

Function | ErrorCallback |

| customerRef |

The Ezidebit Customer Ref used to identify the customer in Ezidebit’s system |

Numeric | 5432102 |

| customerReference |

The Client side method name that is used to identify the customer. |

String | Customer1001 |

| cardNumber |

The client side element name that is capturing the customer’s card number (usually an input of type text). This is the card number that will be used for future direct debit payments. Do not supply a value if updating to use a bank account |

Numeric

(max 16 digits) |

4434123456789351 |

| cardExpiryMonth |

The client side element name that is capturing the customer’s card month expiry date (usually an input of type text) Mandatory where cardNumber is provided |

Numeric

(two digits) |

12 |

| cardExpiryYear |

The client side element name that is capturing the customer’s card year expiry date (must be 4 digits, usually an input of type text). Mandatory where cardNumber is provided |

Numeric

(four digits) |

2016 |

| nameOnCard |

The client side element name that is capturing the customer’s name as it appears on their card (usually an input of type text). Mandatory where cardNumber is provided |

String

(max 100 char) |

John Smith |

| accountName |

The client side element name that is capturing the customer’s bank account name (usually an input type of text). Do not supply a value if updating to use a credit card |

String

(max 100 char) |

John Smith |

|

accountBSB |

The client side element name that is capturing the customer’s BSB number (usually an input type of text). Mandatory where accountName is provided |

Numeric

(six digits) |

124001 |

| accountNumber |

The client side element name that is capturing the customer’s account number number (usually an input type of text). Mandatory where accountName is provided |

Numeric

(max nine digits) |

789654123 |

Response

If the values entered by the customer are invalid, the submitError callback is invoked and will pass an error message together with the element that contains the problem value. An example of a submitError callback is shown below, in which the handler displays the error message and highlights the problem element with a red background and border.

If the call to the server was successful, but the server returned an error message then the same callback given to SubmitCallback is called and passes an errorMessage but no element.

Complete Examples

We have a sample pack of HTML pages that you can download or check out a few implementations:

View the source or download the files to see how they work.

Real-time Credit Card Transaction Response Codes

Please refer to Transaction Return Codes for a list of Transaction Return Codes.

Please refer to Transaction Return Codes for a list of Transaction Return Codes.

Error Response Code

Please refer to Error Codes for a list of Error Codes.

EditCustomerBankAccount

URL

| URL of Web Services | |

| Production (LIVE) | https://api.ezidebit.com.au/v3-5/pci |

| Sandbox (TEST) | https://api.demo.ezidebit.com.au/v3-5/pci |

Description

This method will Add or Edit the Bank Account detail on record for a Customer (Payer).

It is important to note the following when using EditCustomerBankAccount:

- If you are using this method to ADD bank account details to a newly created Customer, you must provide a value of YES in the Reactivate parameter if you want the Customer to be activated so that debits will be taken from them. Newly created Customers are created on a Hold (HB) status until Bank Account or Credit Card details are provided;

- If the Customer currently has Credit Card details on record as the Payment Source, then this function will change the Payment Source for all future payments to the bank account details supplied.

<soapenv:Envelope xmlns:soapenv="http://schemas.xmlsoap.org/soap/envelope/" xmlns:px="https://px.ezidebit.com.au/">

<soapenv:Header />

<soapenv:Body>

<px:EditCustomerBankAccount>

<px:DigitalKey>00000000-0000-0000-0000-000000000000</px:DigitalKey>

<px:EziDebitCustomerID>351328</px:EziDebitCustomerID>

<px:YourSystemReference />

<px:BankAccountName>Joe Smith</px:BankAccountName>

<px:BankAccountBSB>064001</px:BankAccountBSB>

<px:BankAccountNumber>1234</px:BankAccountNumber>

<px:Reactivate>YES</px:Reactivate>

<px:Username>WebServiceUser</px:Username>

</px:EditCustomerBankAccount>

</soapenv:Body>

</soapenv:Envelope>

Request Parameters

| Parameter Name | Description | Format | Example |

|---|---|---|---|

| DigitalKey (Required) |

The 36 character Digital Key supplied to you by Ezidebit to identify your business |

String | 8591BFD4-E7C8-4284-84F7-E6C419114FA8 |

| EziDebitCustomerID |

The unique number assigned to the Customer by Ezidebit. |

Integer | 351328 |

| YourSystemReference |

A unique system identifier for the customer (e.g. GUID or your primary key). You can use this value to identify your Customer in the Ezidebit system if you supplied a value in this field in the AddCustomer method. NB - You must provide a value for either EziDebitCustomerID or YourSystemReference to identify your Customer, but not both. |

String (Max 50 char) | 563445878985432x76 |

| BankAccountName (Required) |

Customer’s bank account name |

String (Max 32 char) | Joe Smith |

| BankAccountBSB (Required) |

Customer’s BSB number |

String (Numeric 6 digits) | 064001 |

| BankAccountNumber (Required) |

Customer’s bank account number |

String (Numeric max 9 digit AU/9-10 digit NZ) | 12345678 |

| Reactivate (Required) |

This field allows you to set the Customer status as Active. NB - If the Customer is already active, passing a value of YES will have no impact. If the Customer is not Active, passing a value of YES will move the Customer to an Active Status. Passing a value of NO will not alter the Customer status. |

String YES or NO |

YES |

| Username |

Optionally record the user in your system that is executing this action |

String (Max 50 char) | Webuser |

<s:Envelope xmlns:s="http://schemas.xmlsoap.org/soap/envelope/">

<s:Body>

<EditCustomerBankAccountResponse xmlns="https://px.ezidebit.com.au/">

<EditCustomerBankAccountResult xmlns:i="http://www.w3.org/2001/XMLSchema-instance">

<Data>S</Data>

<Error>0</Error>

<ErrorMessage />

</EditCustomerBankAccountResult>

</EditCustomerBankAccountResponse>

</s:Body>

</s:Envelope>

Response

The <Data>field in the EditCustomerBankAccount response will be either:

- ’S’ - indicates that the Bank Account details were successfully added to the Customer record;

- Empty - When the Data field is empty, it indicates that the update was not successful.You should check the value of the Error field. If an error has occurred, it will be indicated by a non-zero value in the Error field, with a text descriptor in the ErrorMessage field.

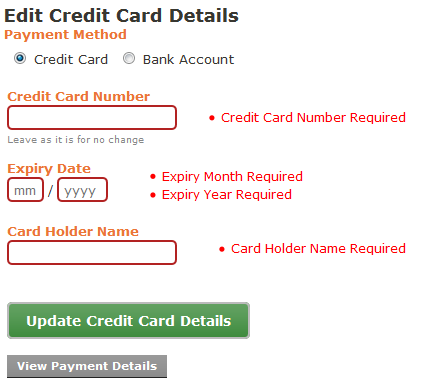

EditCustomerCreditCard

URL

| URL of Web Services | |

| Production (LIVE) | https://api.ezidebit.com.au/v3-5/pci |

| Sandbox (TEST) | https://api.demo.ezidebit.com.au/v3-5/pci |

Description

This method will Add or Edit the Credit Card detail on record for a Customer (Payer).

It is important to note the following when using EditCustomerCreditCard:

- If you are using this method to ADD Credit Card details to a newly created Customer, you must provide a value of YES in the Reactivate parameter if you want the Customer to be activated so that debits will be taken from them. Newly created Customers are created on a Hold (HB) status until Bank Account or Credit Card details are provided;

- If the Customer currently has Bank Account details on record as the Payment Source, then this function will change the Payment Source for all future payments to the credit card details supplied.

<soapenv:Envelope xmlns:soapenv="http://schemas.xmlsoap.org/soap/envelope/" xmlns:px="https://px.ezidebit.com.au/">

<soapenv:Header />

<soapenv:Body>

<px:EditCustomerCreditCard>

<px:DigitalKey>00000000-0000-0000-0000-000000000000</px:DigitalKey>

<px:EziDebitCustomerID>351328</px:EziDebitCustomerID>

<px:YourSystemReference />

<px:NameOnCreditCard>Joe Smith</px:NameOnCreditCard>

<px:CreditCardNumber>4242424242424242</px:CreditCardNumber>

<px:CreditCardExpiryYear>2012</px:CreditCardExpiryYear>

<px:CreditCardExpiryMonth>12</px:CreditCardExpiryMonth>

<px:Reactivate>YES</px:Reactivate>

<px:Username>WebServiceUser</px:Username>

</px:EditCustomerCreditCard>

</soapenv:Body>

</soapenv:Envelope>

Request Parameters

| Parameter Name | Description | Format | Example |

|---|---|---|---|

| DigitalKey (Required) |

The 36 character Digital Key supplied to you by Ezidebit to identify your business |

String | 8591BFD4-E7C8-4284-84F7-E6C419114FA8 |

| EziDebitCustomerID |

The unique number assigned to the Customer by Ezidebit. |

Integer | 351328 |

| YourSystemReference |

A unique system identifier for the customer (e.g. GUID or your primary key). You can use this value to identify your Customer in the Ezidebit system if you supplied a value in this field in the AddCustomer method. NB - You must provide a value for either EziDebitCustomerID or YourSystemReference to identify your Customer, but not both. |

String (Max 50 char) | 563445878985432x76 |

| NameOnCreditCard (Required) |

The name on the customer’s credit card |

String (Max 100) | Joe Smith |

| CreditCardNumber (Required) |

Customer’s credit card number |

String (Numeric Max 16 digits) | 4242000042420000 |

| CreditCardExpiryYear (Required) |

Customer’s credit card expiry year |

Numeric (4 digits) | 2012 |

| CreditCardExpiryMonth (Required) |

Customer’s credit card expiry month |

Numeric (2 digits) | 12 |

| Reactivate (Required) |

This field allows you to set the Customer status as Active. NB - If the Customer is already active, passing a value of YES will have no impact. If the Customer is not Active, passing a value of YES will move the Customer to an Active Status. Passing a value of NO will not alter the Customer status. |

String

YES or NO |

YES |

| Username |

Optionally record the user in your system that is executing this action |

String (Max 50 char) | Webuser |

<s:Envelope xmlns:s="http://schemas.xmlsoap.org/soap/envelope/">

<s:Body>

<EditCustomerCreditCardResponse xmlns="https://px.ezidebit.com.au/">

<EditCustomerCreditCardResult xmlns:i="http://www.w3.org/2001/XMLSchema-instance">

<Data>S</Data>

<Error>0</Error>

<ErrorMessage />

</EditCustomerCreditCardResult>

</EditCustomerCreditCardResponse>

</s:Body>

</s:Envelope>

Response

The <Data> field in the EditCustomerCreditCard response will be either:

- ’S’ - indicates that the Credit Card details were successfully added to the Customer record;

- Empty - When the Data field is empty, it indicates that the update was not successful. You should check the value of the Error field. If an error has occurred, it will be indicated by a non-zero value in the Error field, with a text descriptor in the ErrorMessage field.

GetCustomerAccountDetails

URL

| URL of Web Services | |

| Production (LIVE) | https://api.ezidebit.com.au/v3-5/pci |

| Sandbox (TEST) | https://api.demo.ezidebit.com.au/v3-5/pci |

Description

This method allows you to retrieve the current Bank Account or Credit Card details recorded for the customer.

It is important to note the following when using GetCustomerAccountDetails:

- Credit Card details that are returned will be masked to show only the last four (4) digits;

- Bank Account details that are returned will be masked to show the full BSB number and only the last 50% of the Bank Account digits;

<soapenv:Envelope xmlns:soapenv="http://schemas.xmlsoap.org/soap/envelope/" xmlns:px="https://px.ezidebit.com.au/">

<soapenv:Header />

<soapenv:Body>

<px:GetCustomerAccountDetails>

<px:DigitalKey>00000000-0000-0000-0000-000000000000</px:DigitalKey>

<px:EzidebitCustomerID>351328</px:EzidebitCustomerID>

<px:YourSystemReference />

</px:GetCustomerAccountDetails>

</soapenv:Body>

</soapenv:Envelope>

Parameters

| Parameter Name | Description | Format | Example |

|---|---|---|---|

| DigitalKey (Required) |

The 36 character Digital Key supplied to you by Ezidebit to identify your business |

String | 8591BFD4-E7C8-4284-84F7-E6C419114FA8 |

| EzidebitCustomerID |

The unique number assigned to the Customer by Ezidebit. |

Integer | 351328 |

| YourSystemReference |

A unique system identifier for the customer (e.g. GUID or your primary key). You can use this value to identify your Customer in the Ezidebit system if you supplied a value in this field in the AddCustomer method. NB - You must provide a value for either EziDebitCustomerID or YourSystemReference to identify your Customer, but not both. |

String (Max 50 char) |

563445878985432x76 |

<s:Envelope xmlns:s="http://schemas.xmlsoap.org/soap/envelope/">

<s:Body>

<GetCustomerAccountDetailsResponse xmlns="https://px.ezidebit.com.au/">

<GetCustomerAccountDetailsResult xmlns:i="http://www.w3.org/2001/XMLSchema-instance">

<Data>

<AccountHolderName>JOE SMITH</AccountHolderName>

<AccountNumber>XX34</AccountNumber>

<BSB>064-001</BSB>

<CardHolderName>JOE SMITH</CardHolderName>

<CreditCardNumber>xxxxxxxxxxxx4242</CreditCardNumber>

<ExpiryMonth>12</ExpiryMonth>

<ExpiryYear>2023</ExpiryYear>

<PaymentMethod>CR</PaymentMethod>

</Data>

<Error>0</Error>

<ErrorMessage />

</GetCustomerAccountDetailsResult>

</GetCustomerAccountDetailsResponse>

</s:Body>

</s:Envelope>

Response

The <Data> field in the GetCustomerAccountDetails response will be either:

- A data set enclosed within the

<Data>tags for both Bank Account and Credit Card Details. Where details do not exist in the Ezidebit system, an empty parameter will be returned; - Empty - When the Data field is empty, it indicates that the request was not successful.

You should check the value of the Error field. If an error has occurred, it will be indicated by a

non-zero value in the

Errorfield, with a text descriptor in theErrorMessagefield.

| Parameter Name | Description | Format | Example |

|---|---|---|---|

| AccountHolderName | Customer’s bank account name | String | John Smith |

| AccountNumber | Customer’s bank account number | String | 123456 |

| BSB | Customer’s bank account BSB | String | 123-456 |

| CardHolderName | The name on the customer's credit card | String | John Smith |

| CreditCardNumber | The customer’s masked credit card number. | String | xxxxxxxxxxxx2346 |

| ExpiryMonth | The customers credit card expiry month. | Integer | 05 |

| ExpiryYear | The customers credit card expiry year. | Integer | 2017 |

| PaymentMethod | The payment method which will be used to debit the customer (DR for Bank Accounts OR CR for Credit Cards) | String | CR |

Processing Instant Payments

Ezidebit provides the ability to process a real time credit card payment, either as a once off payment or as a tokenised recurring payment. The following mechanisms are available for processing real time payments:

- Hosted payment page;

- Javascript method;

- Web services.

Hosted payment page

Ezidebit’s hosted payment page provides an out of the box payment page that is fully PCI compliant. The look and feel of the page can be customised via the Ezidebit Online portal to more closely align to a client’s own branding.

Each client’s unique hosted payment page URL is available from the Ezidebit Online portal under Web Page Configuration in the Admin menu.

The submission page simply requires a HTML form with the action parameter set to your unique URL, for example:

https://simple-business-tech.pay.demo.ezidebit.com.au/

During testing, use the URL available from your sandbox account by logging in to Ezidebit Online and selecting Web Page Configuration from the Admin menu.

The payment submission page can pre-load parameters in the payment page by HTML 'GET’ or 'POST’. Both methods are supported and it is your choice if you wish to hide the entry parameters or not. Which method you use will depend on the level of complexity you wish to implement in your website’s encoding to pass data into the hosted payment page for payment processing.

The URL below is an example of using GET Parameters:

https://simple-business-tech.pay.demo.ezidebit.com.au/?FirstName=Test&LastName=Customer&PaymentReference=Payment123

Input Values

The following form fields are submitted by you to our hosted payments page when your customer is sent to our website to make the payment.

| Input Field Name | Description | Required | Format |

|---|---|---|---|

| Type |

Only valid values (I, B) - I = Individual B = Business |

Yes |

String

(Max 1 Char) |

| PaymentReference |